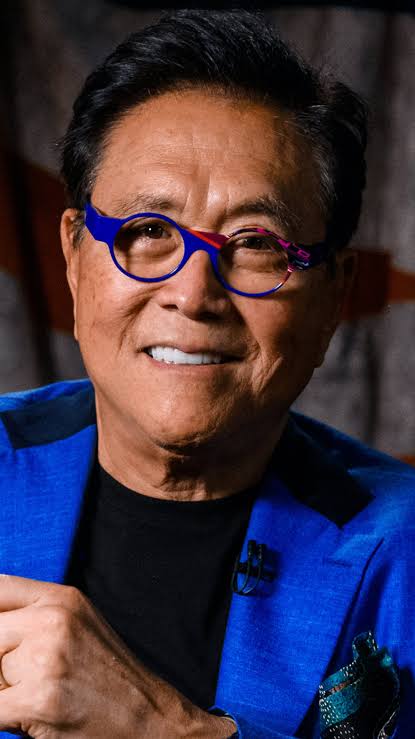

Robert Kiyosaki is a well-known author and financial advisor who has made a name for himself by promoting the idea of using debt to invest in income-generating assets such as real estate. He is also an advocate of the idea of make money work for you, His advice, in books like “Rich Dad Poor Dad,” has been both praised and criticized for its emphasis on leveraging debt as a investment strategy.

Most of the Kiyosaki’s advice revolves around the idea that debt can be a powerful tool for building wealth, especially when used to invest in assets that generate income. By borrowing money to buy real estate, for example, an investor can use the income generated by the property to pay off the debt, while also benefiting from potential appreciation in the property’s value over time. While this strategy can be appealing, it also carries significant risks. One of the main concerns with using debt to invest in real estate is the cost of borrowing. If the interest rate on the debt is high, it can significantly impact the viability of the investment, making it more difficult to generate a positive return on investment.

Additionally, taking on too much debt can lead to financial stress and even bankruptcy if the investor is unable to make the required payments. As with any financial strategy, it’s important to carefully evaluate your own financial situation and goals before deciding to use debt as a tool for investing in real estate.

So, is Robert Kiyosaki’s advice worth following when it comes to using debt to buy real estate? The answer is not a simple yes or no. While there are risks associated with using debt as a financial strategy, it can also be a powerful tool for building wealth if used responsibly.

The key is to carefully evaluate the costs and risks associated with the investment, and to make sure you have a solid plan for managing and paying off any debt you take on. This may involve negotiating a lower interest rate with the lender, choosing a property with a high potential for rental income and appreciation, or carefully managing expenses to maximize the income generated by the property.

Ultimately, the decision to use debt as a financial strategy is a personal one that should be based on your individual financial goals and circumstances. While Robert Kiyosaki’s advice can be a useful starting point, it’s important to do your own research and carefully evaluate the risks and benefits of any investment strategy before making a decision.